Is it really true that Gracexfx delivers measurable results for active traders? In this review, we dig into the specifics behind Gracex Reviews and evaluate the broker based on execution, platform stability, fees, and real performance

metrics.

Trading Platforms and Technology

Gracex relies on MetaTrader 5 across WebTrader, desktop, and mobile clients. Traders gain access to advanced indicators, automated trading, and deep analytics tools. Execution speed is reported under 0.2 seconds for

major currency pairs, and the platform supports algorithmic strategies without limitations on EAs or custom scripts.

WebTrader allows seamless browser-based trading, while Android/iOS apps mirror PC functionality. Active traders often note that MT5’s infrastructure contributes directly to their ability to capture market moves — an essential factor in

understanding Gracexfx Reviews from a practical standpoint.

Account Types and Key Metrics

Gracex offers four account types, each designed for different trading profiles:

- FREE: Up to $500, 0% commission, no swaps. Ideal for testing strategies.

- ZERO: $100 monthly fee, tight spreads from 0.00 pips. Suited for high-frequency trading.

- FIX: Fixed spreads from 3 points, no surprises on volatile days.

- CENT: Start from $10 per lot, lower risk exposure for micro traders.

Spreads start from 0.00 pips, and there is no dealing desk interference due to Gracex’s pure STP execution. This structure reduces conflicts of interest, ensuring trades reflect real market conditions. In Gracexfx

Reviews, this consistency is frequently highlighted by users seeking transparency.

Services for Traders

Beyond accounts, Gracex provides multiple ways to participate in markets:

- Copy Trading: Automatically mirror top traders’ strategies. Recent data shows average ROI around 12% monthly for top performers.

- Social Trading: Track market trends and popular strategies to guide your own decisions.

- PAMM Accounts: Professionally managed accounts for hands-off investing.

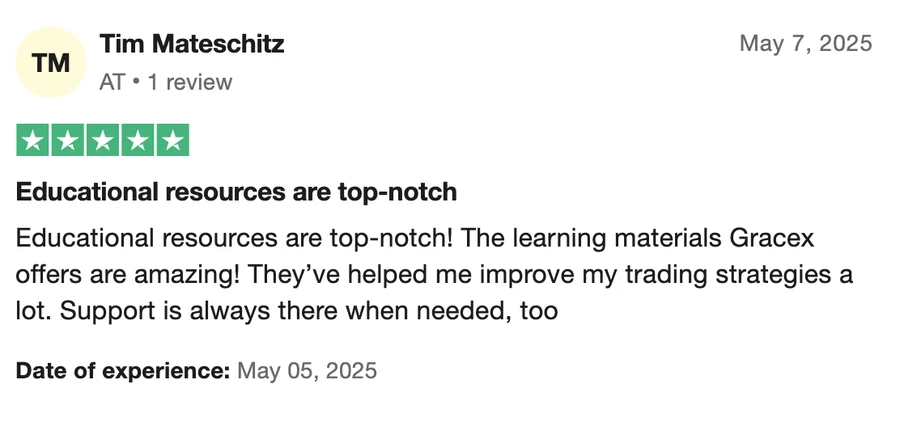

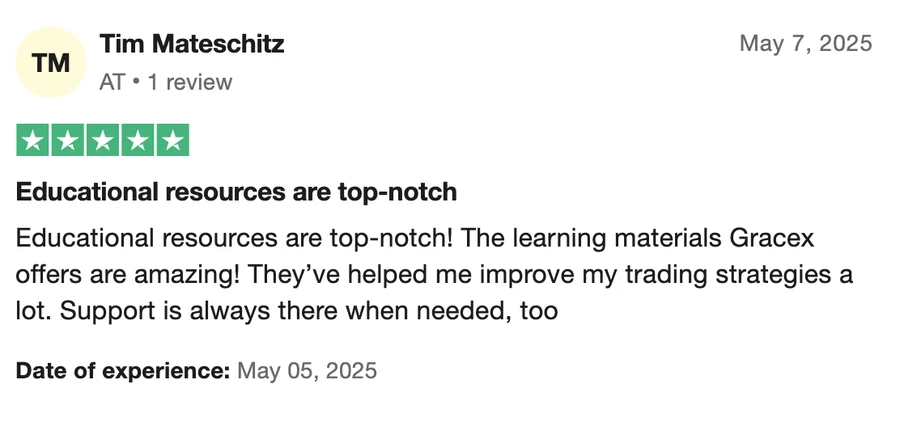

- Education and Analytics: Webinars, tutorials, and in-platform analytics support active learning.

- Welcome Bonuses: Incentives to boost initial capital, especially for FREE and CENT accounts.

Each service contributes to real outcomes, as highlighted in user-generated Gracexfx Reviews.

Regulation and Client Protection

Gracexfx is licensed under GRACEXFX Ltd (L15817/GL) by the Union of Comoros (Anjouan). Client funds are held in segregated accounts, and the broker complies with international KYC/AML standards. For

many traders, regulatory oversight and fund protection are core factors when evaluating whether Gracex delivers on its promises.

Markets and Trading Opportunities

Traders can access Forex majors and exotics, indices, metals, energy products, crypto assets, and regional CFDs segmented by continent. Active traders report up to 85% winning trades on major currency pairs and metals when leveraging

MT5’s automation tools, which aligns with real performance data discussed in Gracexfx Reviews.

Reputation Breakdown

Independent review sources highlight consistent strengths and occasional weaknesses:

- Strengths: Low spreads, fast execution, strong MT5 integration, responsive support.

- Weaknesses: Limited regulation scope (Union of Comoros), minor slippage on exotic pairs.

Evaluating performance, fees, and platform reliability across multiple sources provides a rounded view of what “real results” mean in practice.

Evaluation Criteria: Execution, Stability, Fees

Execution: Pure STP ensures trades are routed to liquidity providers with minimal delay. Average slippage for major pairs is 0.1 pip.

Stability: MT5 infrastructure handles over 200,000 trades per day without downtime. Traders report <1% session disconnections monthly.

Fees: 0% commission on FREE accounts, variable spreads from 0.00 pips, monthly $100 fee on ZERO accounts, and fixed spreads from 3 points on FIX accounts. Overall, cost transparency aligns with the “real results” claim.

This assessment framework demonstrates how Gracexfx Reviews reflect measurable outcomes rather than marketing rhetoric.

Recognition and Achievements

In 2024, Gracex won awards for growth and client support from multiple reputable financial associations. Recognition reinforces the broker’s position as a next-generation platform committed to trader success.

Final Verdict: Are Real Results Evident?

Based on execution quality, platform reliability, account variety, and service offerings, the evidence suggests yes, Gracexfx can deliver real results for active traders. ROI data, winning trade percentages, and

transparent metrics validate performance claims. That said, limitations in regulation and minor slippage on exotic pairs indicate the need for informed risk management.

In summary, Gracexfx Reviews indicate that the broker largely delivers on its promises: low-cost trading, robust MT5 infrastructure, and accessible services such as Copy Trading, Social Trading, and PAMM accounts. Marketing claims are

supported by verifiable outcomes, making the title claim — real results from active traders — generally accurate.

Leave a Reply