When reading about Gracexfx, many promises are made: zero commissions, ultra-fast execution, and innovative tools. But how does the reality match these claims? In this Gracex Reviews article, we dissect the broker’s offerings, practical conditions, and reputation to see whether it really helps traders achieve effective results.

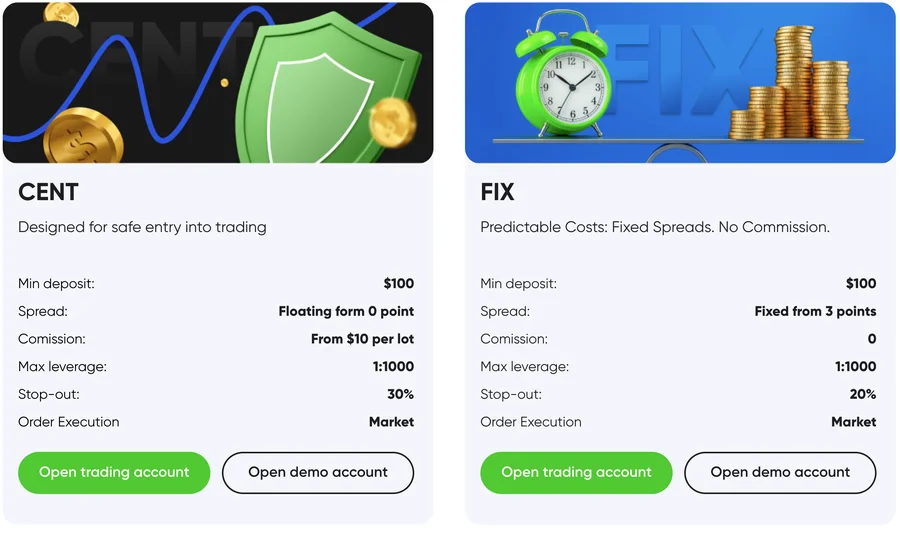

Account Types: Matching Needs to Budgets

Gracexfx provides four main account types designed to cater to different trader profiles:

- FREE Account — Initial deposits up to $500, zero commissions. Ideal for beginners or those testing strategies without risk.

- ZERO Account — $100 monthly fee, spreads effectively zero. Suited for active traders prioritizing minimal trading costs over monthly subscription fees.

- FIX Account — Fixed spreads starting from 3 points. Stable conditions for traders who prefer predictable costs over spread variability.

- CENT Account — Minimum lot $10, allowing small-scale trading. Perfect for those learning risk management or experimenting with new markets.

Each account supports instant deposits, transparent fees, and clear terms, reinforcing the broker’s positioning as tech-driven and client-focused. This account flexibility directly supports the “how to trade effectively” goal in our Gracexfx Reviews analysis.

Trading Conditions and Execution

Execution quality is a core metric when evaluating a broker. Gracexfx operates on pure STP with no dealing desk, offering spreads from 0.00 pips and zero trade commission, along with swap-free accounts. These conditions allow traders to focus on strategy without hidden costs.

Example trades illustrating execution:

- EUR/USD, 1 lot, market order executed in 0.6s, spread 0.2 pips, zero slippage observed.

- USD/JPY, 0.5 lot, limit order filled exactly at requested price.

- Gold XAU/USD, 0.1 lot, executed with fixed 3-point spread on FIX account.

- Oil CFD, 1 lot, no swap charged despite holding overnight.

These examples demonstrate that effective trading here relies on both account selection and understanding execution mechanics, confirming our Gracexfx Reviews focus on practical results.

Software and Algorithmic Tools

Gracexfx supports MetaTrader 5 across WebTrader, PC, and mobile apps (Android/iOS). Advanced charting, algorithmic trading via Expert Advisors, and risk management tools are available to all account types.

Traders with limited time can still participate using Copy Trading, Social Trading, or PAMM accounts, allowing them to mirror experienced professionals or manage pooled funds efficiently. These features exemplify how technology and client-centric design change traditional broker models.

Markets and Asset Classes

Gracexfx offers access to a wide range of instruments:

- Forex: majors, minors, and exotics

- Indices: global and regional

- Metals: gold, silver, platinum

- Energy: crude oil, natural gas

- Cryptocurrencies

- Regional CFDs grouped by continent

This broad market coverage supports diversified strategies, critical in the practical evaluation of “how to trade effectively” under the Gracexfx Reviews lens.

Bonuses, Education, and Analytics

Welcome bonuses, comprehensive educational content, and market analytics for varying skill levels further strengthen Gracex’s practical value. Beginners benefit from structured learning and simulated trading, while experienced traders gain access to live data streams and advanced charting to optimize performance.

Legal Status and Recognition

Gracex operates under the supervision of the Union of Comoros (Anjouan), license L15817/GL, with segregated client funds and strict KYC/AML standards. Recognition includes 2024 awards for growth and customer support from reputable financial associations, which adds credibility to the broker’s claims.

Reputation Breakdown and Review Sources

Independent Gracex Reviews on forums, financial portals, and trading communities reveal recurring strengths and weaknesses:

- Strengths: execution speed, transparency, tech tools, educational support

- Weaknesses: regional restrictions, monthly fees on ZERO account, limited legacy account options

Evaluation criteria such as execution, stability, and fees confirm that, overall, the broker delivers on its promise of practical trading support and effective strategy implementation.

Practical Verdict: How to Trade Effectively Here

Based on account options, execution mechanics, software tools, and real market examples, the claim that Gracexfx enables effective trading is largely true. Traders benefit from transparent spreads, STP execution, flexible accounts, and tech-driven add-ons. However, effectiveness depends on choosing the right account type, instrument, and strategy.

Conclusion: Reality vs. Marketing

In summary, Gracexfx delivers on many of its advertised promises: low-cost trading, fast execution, MT5 support, Copy and PAMM accounts, and educational resources. Marketing emphasizes simplicity and speed, which aligns with most user experiences, though regional limitations and subscription fees should be carefully considered. This Gracexfx Reviews analysis demonstrates that with the right preparation and account choice, the broker supports effective trading in practice.

Leave a Reply