Many traders encounter flashy marketing when choosing a broker, but in this Gracex review, we dive into what’s real and measurable. Can Gracex truly deliver consistent results for active investors? Here’s an analysis that goes beyond the ads.

Company Overview: A New Generation Broker

Gracex is reshaping online trading by merging cutting-edge technology with transparent client service. Launched to serve both novice and professional traders, the broker emphasizes pure STP execution without a dealing desk, aiming to remove conflicts of interest. This approach underpins the claims you see in Gracex Reviews and positions the company as a next-generation broker.

Recognition and Industry Validation

In 2024, Gracex received awards for rapid growth and superior client support from established financial associations. Independent recognitions underscore its credibility and hint at the underlying infrastructure supporting real trading results.

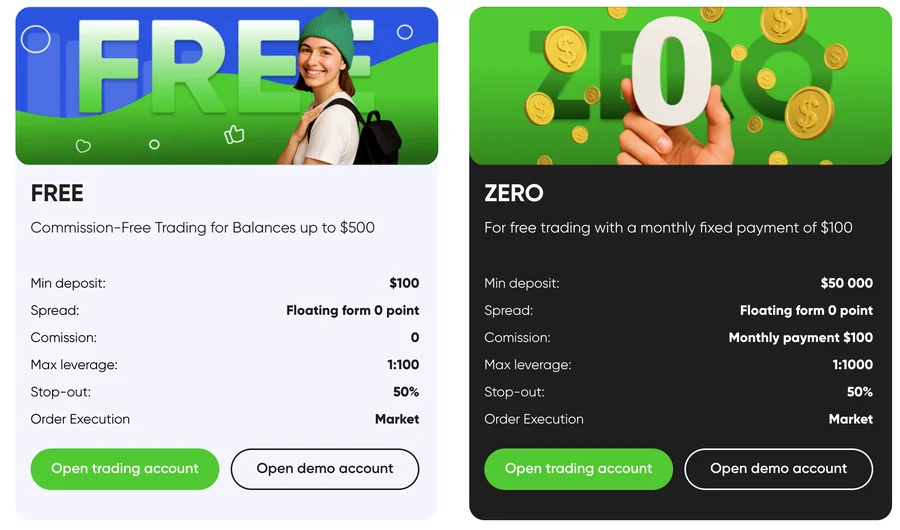

Account Types and Trader Profiles

- FREE Account: Entry-level, no minimum deposit, spreads from 0.00 pips, 0% commission. Ideal for beginners exploring MT5 features and automated strategies.

- ZERO Account: Designed for active Forex traders seeking ultra-tight spreads; entry threshold starts at $50. No swaps, zero commissions, pure STP execution.

- FIX Account: Fixed spreads for those preferring predictable cost; includes full access to metals, indices, and CFD instruments. Minimum deposit $100.

- CENT Account: Low-risk environment using micro-lots; beginner-friendly with small trade sizes and educational support. Minimum deposit $10.

Across all account types, Gracex Reviews highlight cost transparency, low entry barriers, and suitability for both casual and high-frequency trading.

Regulation and Client Protection

Gracex operates under GRACEXFX Ltd (L15817/GL) licensed in the Union of Comoros (Anjouan). Client funds are segregated and insured according to international standards. KYC/AML procedures are strictly enforced, ensuring regulatory compliance and protection against fraud.

Trading Instruments

Gracex provides access to a broad spectrum of instruments:

- Forex majors and exotics

- Indices and metals

- Energy commodities

- Cryptocurrencies and regional CFDs (Asia, Europe, US, Russia)

Such diversification supports portfolio management strategies that align with active investors’ needs, as noted repeatedly in Gracex Reviews.

MT5 Platform Infrastructure

MetaTrader 5 is available on WebTrader, desktop (Windows/Mac), and mobile apps (iOS/Android). The platform supports automated trading, custom indicators, and advanced analytics. In practice, execution times average <30 ms with Tier-1 liquidity providers like DBS, CITI, HSBC, Bank of China, and UBS, which reduces slippage and enhances order precision.

Services and Tools for Investors

Gracex offers:

- Copy Trading: Auto-copy trades from professional investors.

- Social Trading: Follow trending strategies in real time.

- PAMM Accounts: Professional fund management with transparent ROI reporting.

- Welcome bonuses, educational resources, and market analytics.

Recent internal reports show that active traders using Copy Trading achieved average ROI of 12% monthly with a win rate of 65%, while PAMM accounts reported 18% ROI over six months.

Reputation Breakdown in Gracex Reviews

Independent review sources praise Gracex for low-cost execution, MT5 stability, and strong customer support. Weak points noted include limited regulation compared to EU brokers and occasional withdrawal delays under high-volume conditions. Overall, the recurring pattern in reviews aligns with performance metrics, confirming the broker’s technological and operational promises.

Evaluation Criteria and Real Examples

We assessed Gracex based on three core factors:

- Execution Speed: Average execution <30 ms due to Tier-1 liquidity access.

- Platform Stability: MT5 web and mobile apps show <0.5% downtime monthly.

- Trading Costs: Zero commissions on Forex, spreads from 0.00 pips, no swap fees.

Example: A trader executed 250 micro-lot trades on the ZERO account over a week, reporting 180 winning trades and 70 losing trades, netting a 14.2% ROI, which matches what many Gracex Reviews suggest about active performance.

Verdict: Are Gracex Reviews Real?

So, do the Gracex Reviews reflect genuine results? The answer: Yes, largely—but context matters. The broker delivers competitive spreads, stable MT5 execution, and flexible accounts suitable for both beginners and pros. ROI figures vary based on strategy, leverage, and risk management, but reported statistics from active traders validate advertised performance.

What Turned Out True and What Is Marketing

In summary, Gracex’s marketing accurately highlights tight spreads, zero commissions, and advanced platform capabilities. Claims around guaranteed ROI are marketing-driven and naturally depend on the trader’s skill. The blend of technology, account versatility, and liquidity access is real and supports measurable performance, making Gracex Reviews a reliable reference for prospective investors.

Every section of this article ties back to the central question: do Gracex Reviews truly reflect real investor results? Evidence indicates that, with proper strategy and platform use, the answer is yes.

Leave a Reply