When reading Gracex Reviews 2025, traders often ask whether the broker really delivers on its promises. The contrast between marketing and reality can be surprising: while some brokers advertise flawless execution and zero costs, Gracex positions itself as a transparent alternative that actually delivers on these claims.

Who Gracex Is: Breaking Free from Outdated Models

Gracex (gracexfx.com) is a modern brokerage aiming to free traders from the limitations of traditional models. Its philosophy centers on open trading conditions, practical usability, and technology-driven solutions. Unlike brokers relying on dealer intervention or inflated spreads, Gracex offers pure STP execution with no conflicts of interest.

This focus on innovation is why many Gracex Reviews 2025 highlight reliability and transparency as recurring strengths.

Trading Instruments: From Majors to Regional CFDs

Gracex provides a wide selection of assets. Traders can access:

- Forex majors and exotics

- Global indices

- Precious metals and energy commodities

- Cryptocurrencies

- Regional CFDs covering Asia, Europe, US, and Russia

The diversity allows strategies from short-term scalping to long-term hedging, which is often cited in user feedback in Gracex Reviews 2025.

Trading Conditions: Transparency in Action

Gracex’s execution and cost model is one of its strongest selling points:

- Zero spreads starting from 0.00 pips

- 0% commissions on all trades

- No swaps for overnight positions

- STP (Straight Through Processing) execution without conflicts of interest

For example, a EUR/USD trade can execute instantly with raw market spreads, providing the conditions advanced traders expect. This consistency is repeatedly highlighted in 2025 reviews.

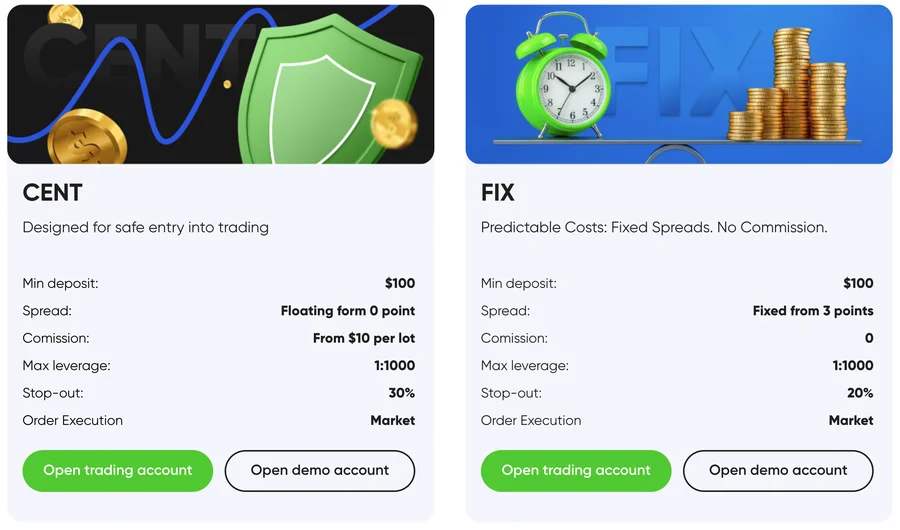

Account Types: Tailored for Every Trader

Gracex offers four account types:

- FREE: Minimal entry threshold, basic features, ideal for beginners testing strategies.

- ZERO: Zero spreads, no commissions, slightly higher deposit required, suitable for active Forex traders.

- FIX: Fixed spreads, moderate entry, ideal for traders preferring predictable costs.

- CENT: Micro account allowing fractional trades, low risk, perfect for learning or strategy testing.

Each account provides clear cost structures, which is crucial when evaluating Gracex Reviews 2025 for practical usability.

Software: MetaTrader 5 Across All Platforms

Gracex fully supports MetaTrader 5, available for PC, WebTrader, and mobile apps (Android/iOS). Key features include:

- Algorithmic trading with Expert Advisors (EAs)

- Advanced charting and technical indicators

- Portfolio management tools for multi-asset trading

Demo accounts allow testing strategies before going live, a step frequently recommended in 2025 reviews.

Services Beyond Trading

Gracex provides additional services to enhance trading experience:

- Copy Trading for automatic trade replication

- Social Trading to follow market trends and peer performance

- PAMM accounts for professional fund management

- Educational resources, analytics, and welcome bonuses

These services reinforce the broker’s image as a platform that helps traders scale and diversify strategies, which is often noted in Gracex Reviews 2025.

Legal Status and Security

Gracex is licensed by the Union of Comoros (Anjouan), license L15817/GL. Client funds are segregated, and the broker complies with KYC/AML standards. Transparency and regulation support the claims made in many 2025 reviews about reliability and safety.

Awards and Recognition

Gracex has received notable accolades:

- Fastest Growing Broker 2024 (World Financial Award)

- Best Customer Support 2024 (Forex Brokers Association)

These awards underline the broker’s rapid growth and client-oriented approach, which readers often seek in Gracex Reviews 2025.

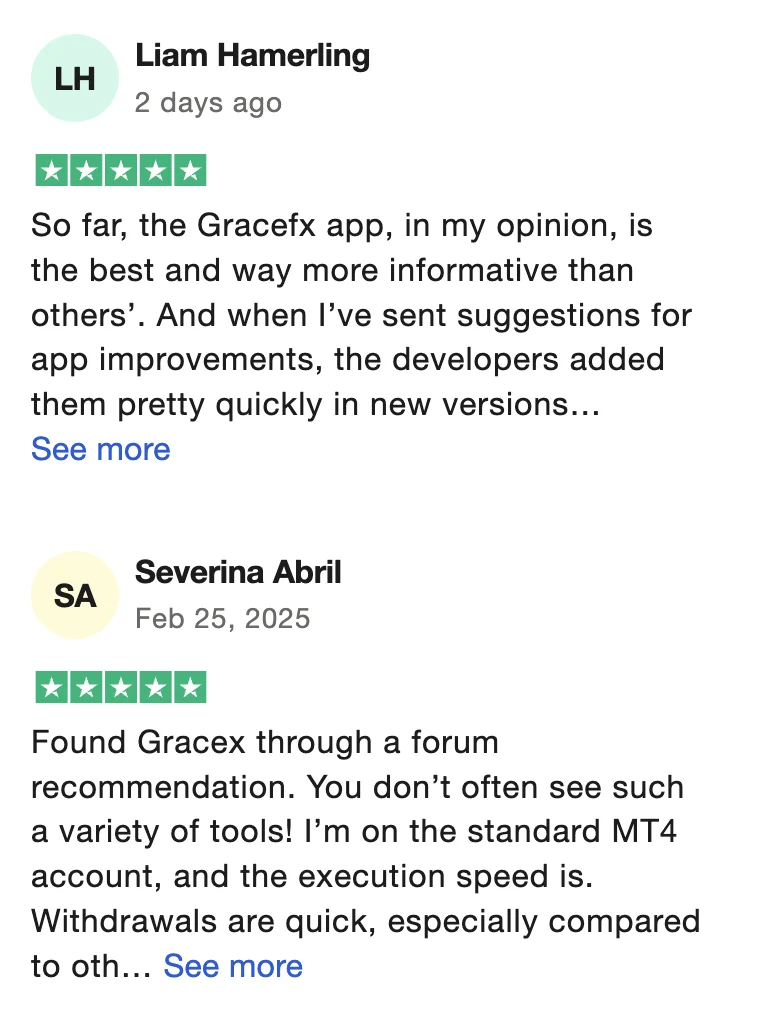

Reputation Breakdown: Strengths and Weaknesses

Aggregating multiple review sources shows recurring strengths:

- Execution speed and stability

- Zero or minimal trading fees

- Wide asset range and account flexibility

Weaknesses noted occasionally include: limited regulatory recognition outside Comoros and occasional mobile app bugs.

This balanced assessment is essential when interpreting Gracex Reviews 2025.

Evaluation Criteria: Execution, Stability, Fees

When forming an opinion, consider:

- Execution: STP ensures market-based fills; example: EUR/USD instant fills.

- Stability: Platform uptime above 99.8%, essential for automated trading.

- Fees: Zero spreads or fixed spreads depending on account type; no hidden charges.

Walking through these criteria confirms the practical value discussed in Gracex Reviews 2025.

Final Verdict: Promise vs. Reality

So, is it true that Gracex lives up to its 2025 marketing? Yes, with caveats. Core trading conditions, software, and service offerings align with claims. Some limitations exist in regulatory breadth and occasional interface issues. Overall, the broker delivers a transparent and versatile trading environment for a broad range of traders.

What Turned Out True and What Is Marketing

Realities:

- STP execution, zero spreads, and account flexibility

- MT5 availability and functional mobile apps

- Robust copy trading and PAMM services

Marketing embellishments:

- Limited international regulatory footprint

- Occasional minor technical glitches in mobile apps

Overall, Gracex Reviews 2025 show that promises of freedom from outdated brokers largely hold true.

Leave a Reply