When exploring Gracex Reviews 2025, traders often wonder what really sets this broker apart beyond the flashy ads. This analysis digs into execution models, fees, account options, software, and market access to provide a practical, no-nonsense overview.

Execution Model and Trading Costs

Gracex operates on a pure STP (Straight Through Processing) model with no dealing desk. This structure removes potential conflicts of interest between broker and trader, ensuring that all orders flow directly to liquidity providers. For active traders, this means execution is transparent, fast, and predictable.

Key metrics are impressive: spreads start from 0.00 pips, there is 0% trade commission on most accounts, and no swaps are charged overnight. By removing hidden costs, Gracex enables traders to calculate all-in trading expenses accurately. As confirmed in multiple Gracex Reviews 2025, this cost transparency is one of the most cited strengths.

Markets and Instruments

Gracex offers a diverse suite of instruments: Forex majors and exotics, indices, metals, energy products, cryptocurrencies, and region-specific CFD lines. This breadth allows traders to diversify across geographies and sectors. Feedback in Gracex Reviews 2025 often highlights the availability of both standard and niche instruments, which appeals to advanced and casual traders alike.

Account Types and Flexibility

- FREE – deposit up to $500; designed for beginners exploring markets with minimal commitment.

- ZERO – $100/month; zero commission, ideal for active traders focusing on raw spreads.

- FIX – spreads from 3 points; suits those preferring predictability in costs.

- CENT – $10 per lot; targeted at micro-traders testing strategies with small stakes.

Across account types, recurring comments in Gracex Reviews 2025 praise the clarity of minimums and fees. Each account serves a defined trading purpose, balancing cost with accessibility.

Software and Technology

Gracex leverages MetaTrader 5 across WebTrader, desktop, and Android/iOS apps. Features include advanced charting, algorithmic trading, and portfolio monitoring tools. The platform’s technology combines simplicity for beginners with depth for professional traders, a theme emphasized in many Gracex Reviews 2025. Algorithmic execution and fast order routing complement the STP model, reinforcing execution reliability.

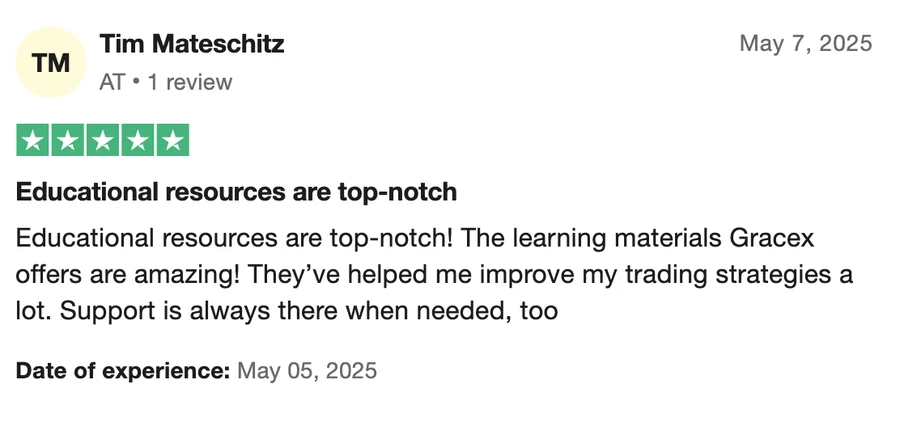

Add-Ons and Education

To enhance trader experience, Gracex offers copy and social trading, PAMM accounts for investors, welcome bonuses, and tiered educational content. Market analytics cater to all skill levels, from novices learning fundamental analysis to professionals leveraging technical indicators. Reviews consistently note that the broker’s educational ecosystem is a differentiating factor in 2025.

Regulation and Security

Gracex is licensed by the Union of Comoros (Anjouan), L15817/GL. Client funds are segregated, and the broker adheres strictly to KYC/AML standards. This framework provides an extra layer of security for users, which is frequently highlighted in online feedback under Gracex Reviews 2025.

Awards and Industry Recognition

In 2024, Gracex was named The Fastest Growing Broker by the World Financial Award and The Best Customer Support by the Forex Brokers Association. These accolades support the broker’s reputation and are regularly mentioned as validation points in public reviews.

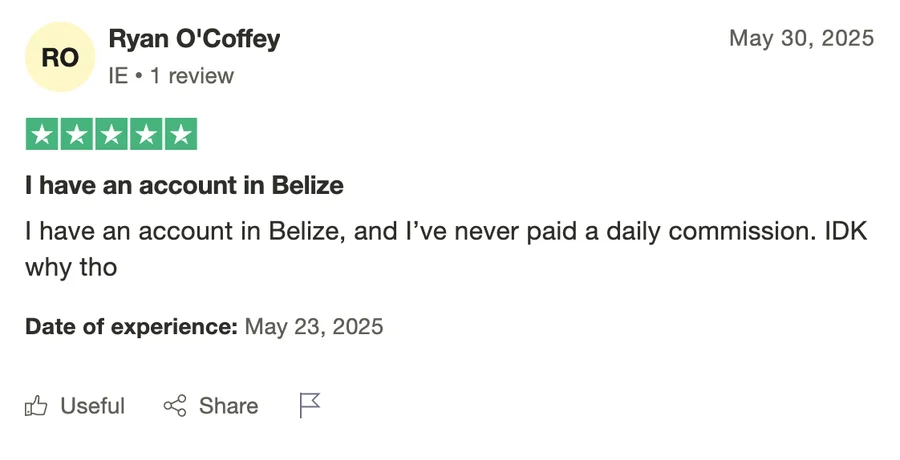

Reputation and Community Feedback

Sources of Gracex feedback include specialized review platforms, independent trading forums, and verified testimonials on multiple domains. Recurring strengths cited are execution speed, transparent pricing, tech-driven approach, and customer support. Common weaknesses involve limited regional availability and occasional platform latency under peak load. Overall, Gracex Reviews 2025 balance these factors, offering a clear picture of user sentiment.

Evaluation Criteria: Execution, Stability, Fees

Analyzing Gracex by common metrics:

- Execution: Fast STP execution, low slippage.

- Stability: MT5 platform with multi-device access; reliable under normal market conditions.

- Fees: Zero commissions on key accounts, spreads from 0.00 pips, no hidden charges.

Case example: a EUR/USD micro-lot trade on the ZERO account incurs no commission and spreads can reach the advertised 0.0–0.2 pips, confirming the broker’s claims in real-world conditions.

Pros and Cons

- Pros: Zero spreads, 0% commission, STP execution, multi-asset access, strong platform tools, recognized awards.

- Cons: Regulatory oversight is limited to Comoros, platform may experience occasional latency, regional CFD availability varies, some advanced tools require experience.

Final Verdict

So, is it true that Gracex lives up to the promise highlighted in Gracex Reviews 2025? Based on cost transparency, execution model, software, and overall market coverage, the answer is: yes, with context. Traders seeking STP execution, low-cost trading, and multi-asset access find Gracex highly competitive. However, regional limitations and occasional latency mean that the experience may differ slightly depending on location and trade size.

In conclusion, Gracex Reviews 2025 present a tech-driven, trader-focused broker that challenges conventional practices while maintaining clarity in costs, accounts, and services.

Leave a Reply