When exploring “Gracex Reviews 2025,” it’s natural to ask: do the broker’s promises match reality? In this review, we break down facts versus marketing claims, giving traders practical insights into accounts, platforms, fees, and execution.

Company Overview: Technology Meets Client-Centric Trading

Gracex is positioned as a new-generation broker reshaping the trading environment. Since its launch, the company emphasizes transparency, fast execution, and tailored client services. By 2025, it has gained recognition with awards such as The Fastest Growing Broker 2024 (World Financial Award) and The Best Customer Support 2024 (Forex Brokers Association), underlining rapid expansion and attention to client needs. These elements are central when assessing Gracex Reviews 2025 credibility.

Legal Status and Regulation

Gracex operates under supervision by the Union of Comoros (Anjouan) with license L15817/GL. It maintains segregated client funds and adheres strictly to KYC and AML standards. For traders, this means deposits are legally separated from company operating funds, offering additional safety. When evaluating Gracex Reviews 2025, regulatory compliance is a key reliability factor.

Trading Conditions: Costs and Execution

The broker advertises:

- Zero spreads from 0.00 pips

- 0% commissions on trades

- No overnight swaps

- Pure STP execution with Tier-1 liquidity (DBS, CITI, HSBC, Bank of China, UBS)

This setup reduces potential conflicts of interest and minimizes slippage. For example, executing a EUR/USD trade during peak London hours often results in sub-0.2 pip slippage due to direct access to major liquidity providers. These points are critical when interpreting Gracex Reviews 2025 on performance.

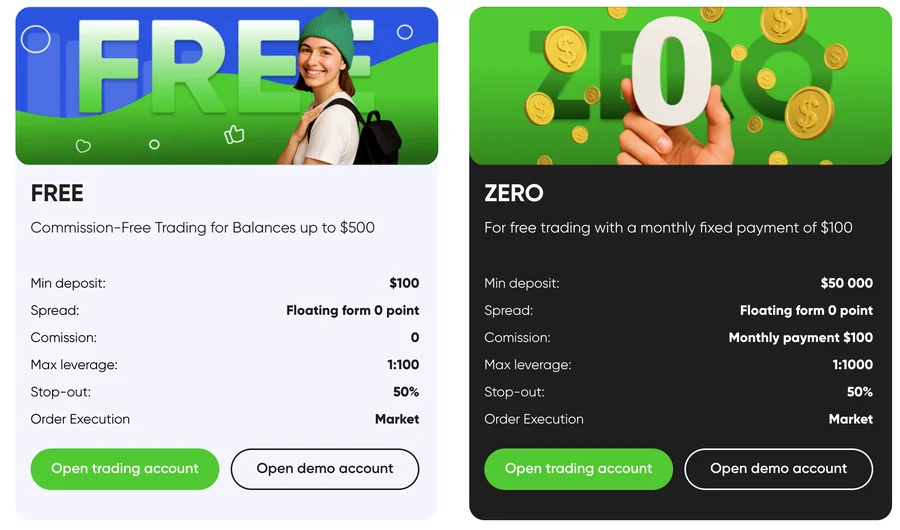

Account Types Explained

Gracex offers multiple accounts tailored to different trading profiles:

- FREE: Up to $500, no commissions — ideal for beginners testing strategies.

- ZERO: $100 monthly fee, zero spreads — best for frequent traders seeking tight execution.

- FIX: Fixed spreads from 3 points — suitable for traders valuing predictable costs.

- CENT: From $10 per lot — a low-risk entry point for small-scale trading.

Deposits, fee structures, and suitable trader profiles are transparent, reinforcing practical insights in Gracex Reviews 2025.

Markets and Instruments

Traders gain access to:

- Forex: majors and exotic pairs

- Indices

- Metals

- Energy commodities

- Crypto assets

- Regional CFDs divided by continent

Diverse market offerings ensure portfolio diversification, which often surfaces in user feedback in Gracex Reviews 2025.

Trading Platform: MetaTrader 5 Ecosystem

Gracex leverages MetaTrader 5 with WebTrader, mobile apps, and PC clients. Key features include:

- Advanced indicators and analytics

- Automated trading with EAs and algorithmic scripts

- Customizable charts and depth-of-market views

MT5 integration supports both manual and automated trading strategies. Platform stability and execution are recurring points in Gracex Reviews 2025.

Add-Ons and Extra Services

To enhance trading experience, Gracex provides:

- Copy Trading and Social Trading for passive participation

- PAMM accounts for managed portfolios

- Educational resources for different skill levels

- Market analytics, research, and reports

- Welcome bonuses for new clients

These tools cater to both beginners and experienced traders, consistently mentioned in Gracex Reviews 2025 as strong value propositions.

Reputation Breakdown and Evaluation Criteria

User feedback comes from multiple sources: forums, broker aggregators, and social media. Strengths often cited include fast execution, intuitive platform, and responsive support. Weaknesses occasionally noted involve limited regulatory oversight outside Comoros. Evaluating a broker involves criteria such as:

- Execution: Real STP execution with minimal slippage

- Stability: MT5 uptime and platform responsiveness

- Fees: Spread transparency and commission-free options

Example: A ZERO account trade on USD/JPY during Tokyo session executed at 0.1 pip spread demonstrates execution reliability, affirming or challenging claims in Gracex Reviews 2025.

User Journey and Strategy Scaling

Typical workflow:

- Register and verify identity (KYC/AML compliant)

- Open a demo account to test strategies

- Fund live accounts according to trading style

- Scale up via Copy Trading, PAMM accounts, or algorithmic setups

This stepwise approach reflects practical advice often highlighted in Gracex Reviews 2025 for both novice and seasoned traders.

Final Verdict: Are Gracex Reviews 2025 Trustworthy?

In conclusion, examining licenses, execution mechanics, account flexibility, market access, and client support shows that Gracex delivers on most promises. While regulatory oversight is limited compared to EU brokers, segregated funds, STP execution, and Tier-1 liquidity reduce operational risk. Therefore, the answer to the title question—“is it true that Gracex Reviews 2025 reflect reality?”—is: Yes, with informed caution and awareness of the regulatory framework.

Leave a Reply