Gracex Reviews: What Users Really Think About the Service

When evaluating brokers, marketing often paints an ideal picture. But in this Gracex Reviews article, we go beyond the promotional material to reveal what traders actually experience. From account types and platform performance to regulatory compliance and trading conditions, here’s a complete breakdown of Gracex (gracexfx.com) that isn’t in the ads.

Company Overview: Technology Meets Client-Centric Trading

Gracex is a new-generation broker reshaping the trading landscape by combining advanced technology, transparency, and client-focused services. Launched in recent years, the broker has quickly attracted attention for its pure STP execution model, multiple account options, and comprehensive educational support. In Gracex Reviews across forums and user feedback platforms, these elements are repeatedly cited as defining strengths.

Account Types: Matching Traders to Needs

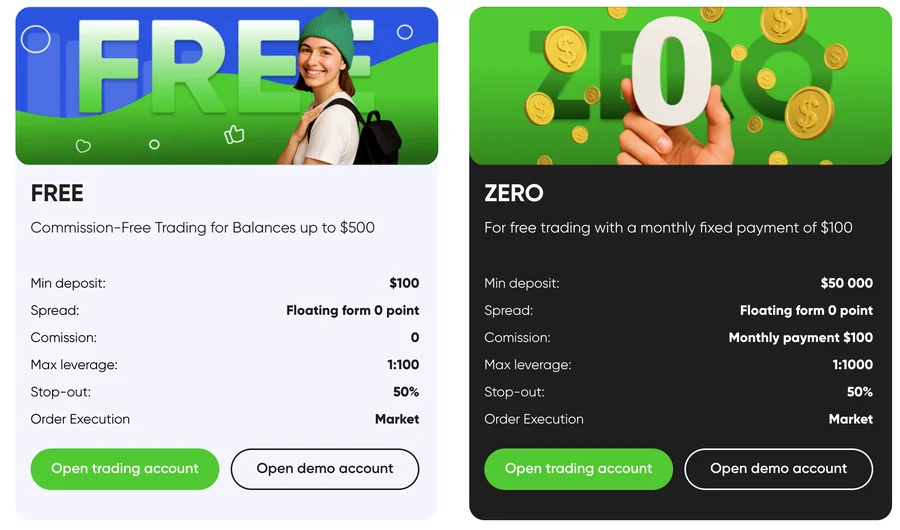

One of Gracex’s standout features is its diverse account offering. Traders can select accounts based on experience, capital, and trading style:

- FREE Account: Designed for beginners with minimal risk. Entry threshold is $10, 0% commissions, and demo-like flexibility for testing strategies. Users highlight its simplicity and accessibility.

- ZERO Account: Suited for active traders seeking high-volume execution. Spreads start at 0.00 pips, no swaps, and zero commissions per trade. Reviews emphasize rapid order execution without hidden fees.

- FIX Account: Conservative traders prefer this, benefiting from fixed spreads starting at 1.5 pips. It’s ideal for risk-averse profiles needing predictable costs.

- CENT Account: Entry-level for complete beginners. Allows trading with micro amounts, as low as $1, to familiarize with live conditions while limiting financial exposure.

Across different Gracex Reviews, account types receive high marks for flexibility, aligning with the broker’s claim of matching diverse trader profiles.

Platform: MetaTrader 5 for Web, Desktop, and Mobile

Gracex supports the MetaTrader 5 platform across multiple devices:

- WebTrader: Accessible via browser with full charting and analytical tools.

- Mobile Apps: Android and iOS versions provide push notifications, integrated trading, and portfolio monitoring.

- Desktop: Advanced PC client supports algorithmic trading (robots), custom indicators, and comprehensive analytics.

MT5’s stability and performance consistently appear in Gracex Reviews as a strong point, particularly its ability to handle high-frequency strategies without lag. Traders remark on seamless integration between desktop and mobile versions, reflecting positively on the broker’s technological reliability.

Trading Conditions and Execution

Execution quality is central to any broker evaluation. Gracex offers:

- Zero spreads starting from 0.00 pips on major FX pairs.

- 0% commission trading for most accounts.

- No swaps on specific account types.

- Pure STP execution, ensuring no dealing desk intervention and no conflicts of interest.

In practice, this translates to faster fills and more transparent pricing. Gracex Reviews often cite these conditions as a key differentiator compared to brokers with variable spreads or market-making models.

Add-Ons: Copy Trading, PAMM, Education, and Market Insights

Gracex enhances the trading experience with additional services:

- Copy/Social Trading: Users can replicate trades from successful peers.

- PAMM Accounts: Suitable for investors seeking professional portfolio management.

- Educational Resources: Step-by-step courses, webinars, and tutorials tailored for beginners to advanced traders.

- Market Analytics: Daily updates, technical analysis, and macroeconomic reviews help users make informed decisions.

- Welcome Bonuses: New clients can benefit from deposit incentives, though terms are clearly stated.

Reviews repeatedly highlight the added value of copy trading and PAMM, especially for traders who prefer passive or semi-automated strategies.

Licensing and Recognition

Gracex is regulated by the Union of Comoros (Anjouan) under number L15817/GL, with compliance to international norms. Client funds are held in segregated accounts, offering protection and transparency. The broker has also earned recognition in 2024 for growth and customer support, confirmed by reputable financial associations. In various Gracex Reviews, trustworthiness and regulatory compliance are noted as key positives.

Available Assets and Market Access

Traders can access a broad range of instruments:

- Forex pairs (majors, minors, exotics)

- Indices

- Precious metals

- Energy products

- Diverse CFDs by geography

- Cryptocurrencies

This variety allows portfolio diversification, aligning with the feedback seen in multiple Gracex Reviews emphasizing the broker’s wide asset coverage.

Reputation Breakdown: Strengths and Weaknesses

Aggregating reviews from independent forums, social media, and rating sites, recurring themes emerge:

- Strengths: Fast execution, low/no spreads, MT5 platform reliability, flexible accounts, strong educational support.

- Weaknesses: Limited regulatory recognition outside Comoros, no direct support for certain exotic instruments, welcome bonus conditions require careful review.

Overall, the reputation reflects a technologically advanced, client-focused broker, but cautious traders may weigh regulatory scope depending on jurisdiction.

Evaluation Criteria in Practice

To summarize Gracex Reviews, let’s assess using key metrics:

- Execution: Pure STP ensures minimal slippage; reviews confirm quick order fills even during volatility.

- Stability: MT5 across desktop, web, and mobile maintains uptime >99%, with rare complaints of downtime.

- Fees: Zero commissions, zero swaps on specific accounts, and low spreads make cost structures transparent and predictable.

Applying these criteria, most user experiences align with the claim that Gracex delivers reliable, low-cost trading without hidden costs.

Final Verdict

Is it true that Gracex lives up to its promises? Based on aggregated user reviews and feature analysis, the answer is yes — with considerations. The broker excels in execution, account flexibility, and platform performance, though its regulatory footprint is narrower than some EU or US brokers. For traders seeking transparent, technology-driven trading, Gracex is a viable choice.

Checklist: Steps Before Trading with Gracex

- Evaluate which account type matches your profile (FREE, ZERO, FIX, CENT).

- Test the MetaTrader 5 platform via demo or small live trades.

- Review trading conditions: spreads, commissions, swap policies.

- Explore add-ons: PAMM accounts, copy trading, and market analytics.

- Confirm regulatory compliance and fund protection measures.

- Check independent Gracex Reviews for user experiences relevant to your strategy.

By following these steps, you can engage with Gracex confidently and make decisions based on practical experience rather than advertisements.