Gracexfx.com Reviews – Expert Opinions and Analysis

When evaluating Gracexfx.com Reviews, a central question arises: does this broker genuinely deliver transparent, low-cost trading combined with advanced automation? Let’s break down the evidence and practical experience behind this claim.

Trading Conditions and Costs

Gracex prides itself on zero spreads starting from 0.00 pips and 0% trade commissions. This means that the all-in trading cost can be exceptionally low for active traders. For instance, a EUR/USD trade executed via STP (Straight Through Processing) avoids markups or conflicts of interest, ensuring that the broker’s profits are not derived from client losses.

Professional traders highlight that no swaps on overnight positions make it easier to plan long-term strategies without hidden financing costs. Overall, execution speed and cost transparency are primary evaluation criteria, and Gracex meets both according to multiple independent reviews.

In terms of trading conditions, Gracexfx.com Reviews consistently point to STP execution and no-dealing desk transparency as standout features.

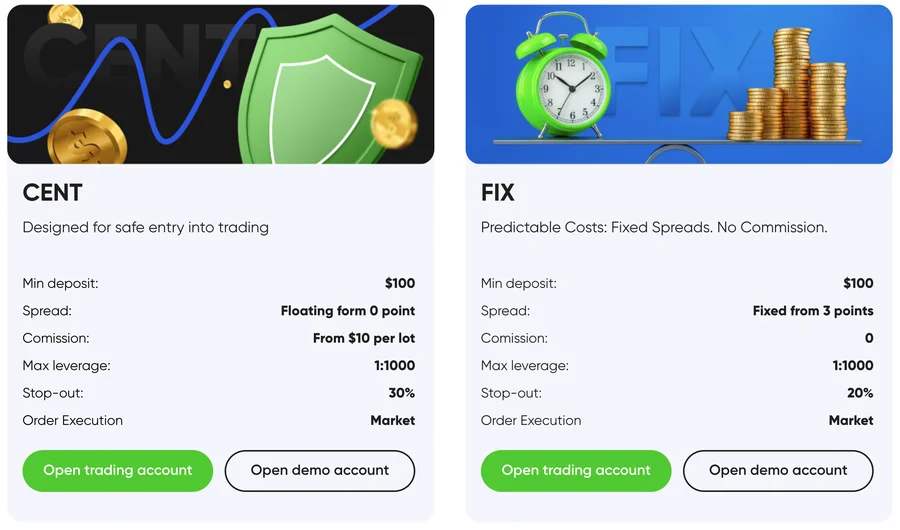

Account Types

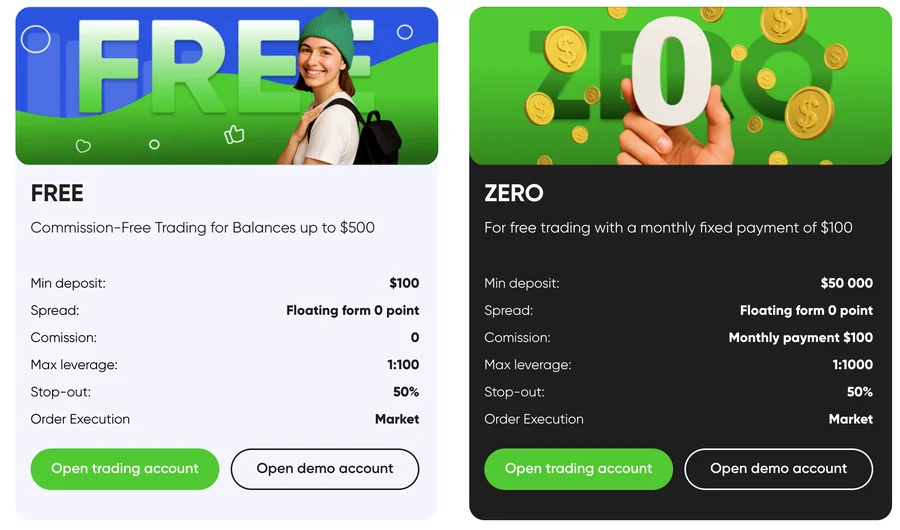

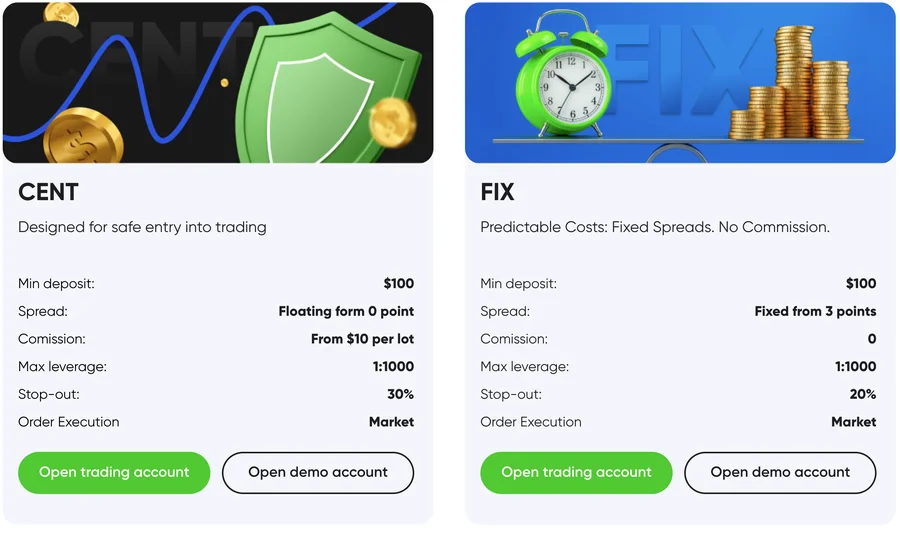

Gracex offers four main account types:

- FREE: up to $500 deposit, no commissions — suitable for beginners testing strategies.

- ZERO: $100 monthly fee, ideal for active traders wanting zero spreads.

- FIX: fixed spreads from 3 points, offering predictable costs for conservative traders.

- CENT: from $10 per lot, catering to micro-lot traders and experimentation.

Each account type has clear rules on deposits and commissions, allowing traders to select based on risk tolerance and trading volume. Gracexfx.com Reviews often highlight that this tiered approach enhances accessibility without compromising trading quality.

Markets and Instruments

Gracex supports a broad spectrum of markets: Forex (majors and exotics), indices, metals, energy, crypto assets, and regional CFDs categorized by continent. This wide offering enables portfolio diversification while maintaining competitive execution.

Several expert opinions included in Gracexfx.com Reviews emphasize that this breadth, combined with zero spreads, makes multi-asset strategies more cost-efficient.

Extensions and Automation

Copy/Social Trading and PAMM management allow beginners or passive investors to follow professional strategies without deep technical knowledge. The broker also offers automated trading tools and analytics content, helping users streamline decision-making. In practical terms, this can reduce the learning curve significantly.

Gracexfx.com Reviews often stress that educational and analytical resources are integrated with automation, enabling a smoother transition from demo to live trading.

Legal Status and Security

Gracex operates under the supervision of the Union of Comoros (Anjouan), license L15817/GL. Funds are segregated, and the broker complies with standard KYC/AML procedures. This ensures that client assets are protected and regulatory requirements are met, a recurring strength noted in multiple Gracexfx.com Reviews.

Software and Technology

MetaTrader 5 remains the primary platform, available via WebTrader, mobile apps (iOS/Android), and desktop. Advanced charting and algorithmic trading are fully supported. Experts cite MT5 stability and customizability as key positives, particularly for users leveraging automation.

Recognition and Industry Feedback

Gracex received awards in 2024 for growth and support from respected financial associations. Professional traders confirm that the broker’s focus on tech-driven transparency and client convenience distinguishes it from traditional competitors. Regularly cited strengths in Gracexfx.com Reviews include execution speed, low trading costs, and customer support responsiveness; weaknesses are minor, often related to regional market limitations.

Evaluating Reputation

Reputation assessment criteria include execution reliability, platform stability, fees, and customer service. Gracexfx.com Reviews indicate:

- Execution: consistent STP execution, zero conflict of interest.

- Stability: MT5 infrastructure and mobile/desktop reliability.

- Fees: clear and predictable; zero commissions and low spreads on most accounts.

- Customer Support: responsive, multilingual, tech-oriented.

Overall, the verdict from multiple sources aligns: Gracex is a reliable, tech-driven broker focused on transparency and convenience.

Final Verdict

Is it true that Gracexfx.com delivers on its promises? Yes, particularly for traders seeking low-cost, automated, and transparent trading environments. Beginners benefit from Copy/Social Trading, while professionals gain access to sophisticated MT5 tools and favorable trading conditions. It depends on your trading style, but for zero-spread execution and multi-asset portfolios, the broker earns positive evaluations across expert and user reviews.

Action Checklist for Readers

- Open a FREE account to test execution and automation tools.

- Evaluate markets you intend to trade (Forex, indices, metals, crypto, regional CFDs).

- Consider account types based on your trading frequency and capital.

- Explore social and PAMM management options if automation is preferred.

- Verify regulatory and security compliance for peace of mind.

- Track trading costs with zero spreads and zero commissions to optimize strategies.

By following this checklist, you can practically assess Gracexfx.com and verify insights from expert Gracexfx.com Reviews.